CAMRT’s PLI Program

What is Professional Liability Insurance (PLI)?

Professional Liability insurance (PLI) protects you against liability or allegations of liability for injury or damages that have resulted from a negligent act, error, omission, or malpractice that has arisen out of your professional capacity as a medical radiation technologist. PLI protects MRTs by ensuring that your legal defence is coordinated and paid for if a claim is made against you. Your PLI also covers the cost of client compensation, or damages.

PLI Coverage Summary Common Myths Claims Examples In the Event of a ClaimIt’s Included in CAMRT Membership

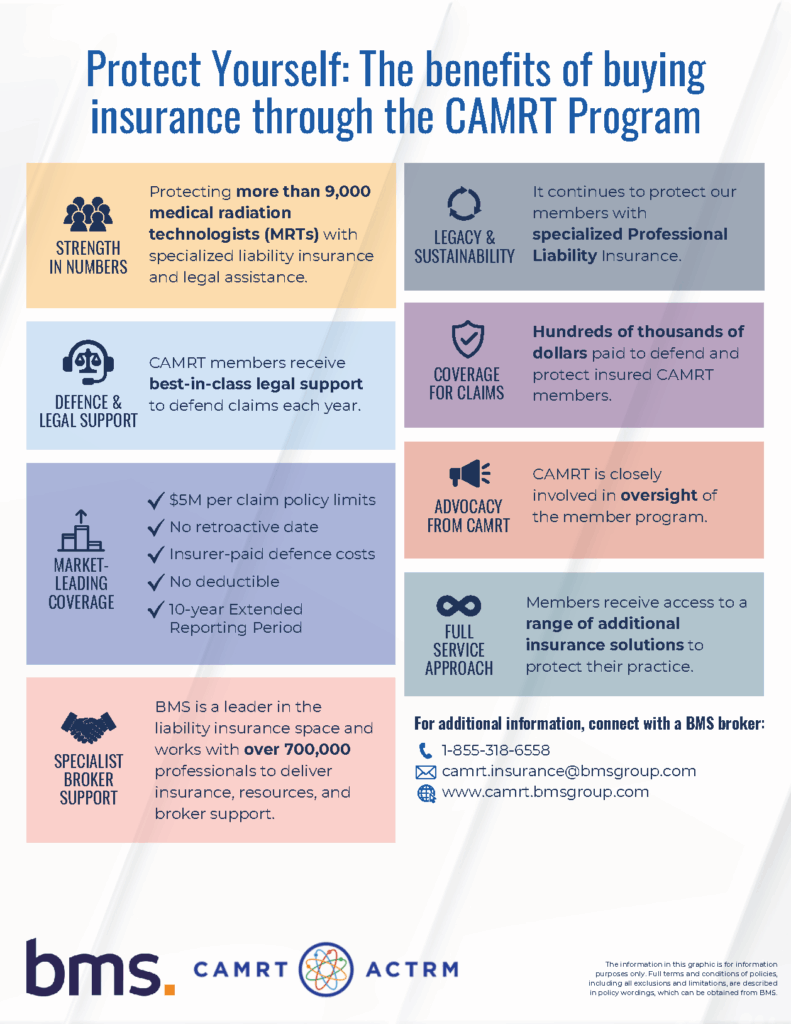

CAMRT has provided MRTs with PLI for over 25 years and currently over 9,000 MRTs in Canada are enjoying the peace of mind that our PLI program offers. Available exclusively to members of the Canadian Association of Medical Radiation Technologists, our PLI is available with Full Practice, Temporary Practice and Life Memberships.

Attention Diagnostic Medical Sonographers: If you are a CAMRT-certified medical radiation technologist practicing diagnostic medical sonography, the CAMRT’s PLI policy will provide you with coverage for your practice of sonography.

Become a member today to get the peace of mind that comes with knowing that you are completely protected against professional liability.

Summary of Coverage

Coverage Highlights:

- Coverage that meets and exceeds requirements set by provincial regulatory bodies

- Regulatory legal defense (disciplinary) coverage

- Criminal defense reimbursement

- It’s personal PLI – meaning it’s yours and yours alone and follows you wherever you work in Canada, even at multiple sites

- FREE legal advice

The policy also includes unique policy extensions such as:

-

- Loss of earnings coverage

- Coroner’s hearing expenses

- Sexual abuse therapy & counselling fund

- Retirement coverage

Download the Complete Policy – A copy of the full policy is available to members by logging into their CAMRT Member Account.

Why Do You Need Professional Liability Insurance?

The reason healthcare professionals need Professional Liability Insurance (PLI) is quite simple. In our legal system if you are alleged to have done or failed to do anything that is a breach of the standard of care in our profession, and that breach ca uses damage, someone can sue you for damages. If you are sued, whether you were negligent or not, you will need legal defense and you can turn to your CAMRT PLI.

A PLI claim can be devastating financially for the MRT without adequate insurance to obtain legal counsel. Even a frivolous allegation can result in crippling defense costs, and such allegations are on the rise.

Requirement from Regulatory Bodies

All licensed medical radiation technologists in the provinces of Alberta, New Brunswick, Nova Scotia, Ontario, Prince Edward Island, Quebec and Saskatchewan are required to have PLI coverage as specified by the regulatory college in that province. The comprehensive PLI coverage included with a CAMRT membership meets or exceeds all of the minimum requirements for PLI set by the regulatory bodies in these provinces.

Not all Policies are the Same!

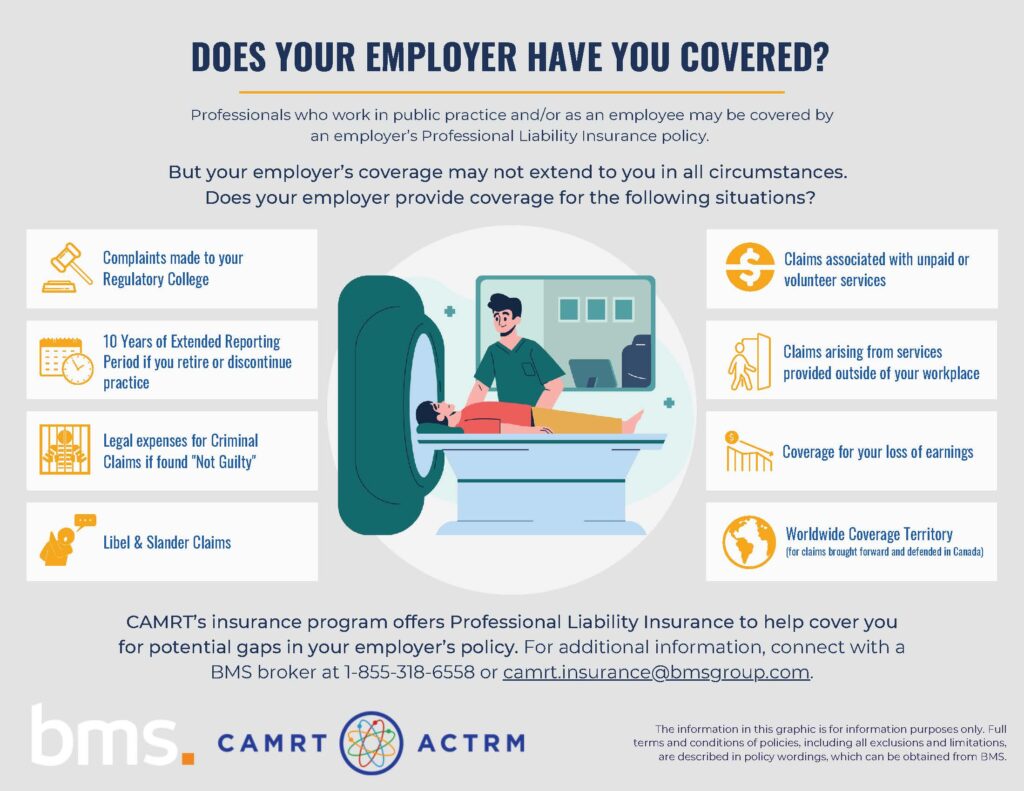

Workplaces and unions may offer insurance, BUT not all policies are the same. Other policies may leave you vulnerable in the case of a claim. CAMRT membership has you covered.

If your employer states they provide you with PLI, make sure to fully investigate the extent of the coverage.

Things to consider:

- Are you covered for a hearing with your regulatory body or your provincial organization?

- Are you covered for legal defense insurance for court cases filed under the Criminal Code?

- Will your employer insurance still cover you if you are fired you over an incident?

- Is your employer insurance a shared pool of coverage?

The CAMRT policy covers all of this and more.

- Learn more about the CAMRT PLI Policy

- For more information about your Insurance Broker, BMS, and Insurance Regulatory Principles of Conduct, please click here.https://www.youtube.com/watch?v=-yTc74sZlY0